Deferred compensation plan calculator

RSA-1 is a powerful tool to help you reach your retirement dreams. Effective April 1 2022 Empower officially acquired the full-service retirement business of Prudential.

Financial Calculators

And one is riskier than the other.

. As a supplement to other retirement benefits or savings that you may have this voluntary plan allows you to save and invest extra money for retirement tax-deferred. Qualified Deferred Compensation Plans. For more details review the important information PDF opens in a new window associated with the acquisition.

DCP is an IRC Section 457 plan administered by the Washington State Department of Retirement Systems DRS. Unlike traditional savings accounts DCP is tax-deferred it lowers your taxable income while you are working and it delays payments of income taxes on your investments until you withdraw your funds. Types of Deferred Compensation Plans.

Qualified deferred compensation plans are tax-deferred pension plans covered by the Employee Retirement Income Security Act of 1974 ERISA. RSA-1 Deferred Compensation Plan. DCP is a great way to save.

There are two different types of deferred compensation plans.

914 457 Images Stock Photos Vectors Shutterstock

Mpsers Employer News May 2022

914 457 Images Stock Photos Vectors Shutterstock

Looking For Secure Retirement A 457 Plan Could Be The Best Tool For Creating A Secure Retirement Use Our 457 Retirement P How To Plan Finance Blog Retirement

2

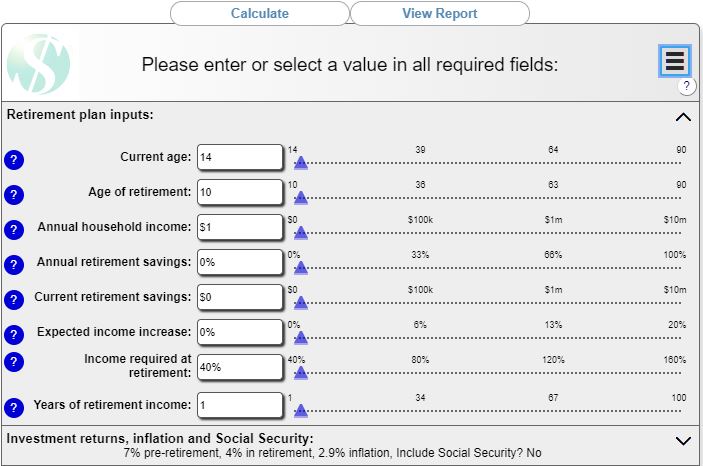

Retirement Planner

914 457 Images Stock Photos Vectors Shutterstock

Vrs Contributions

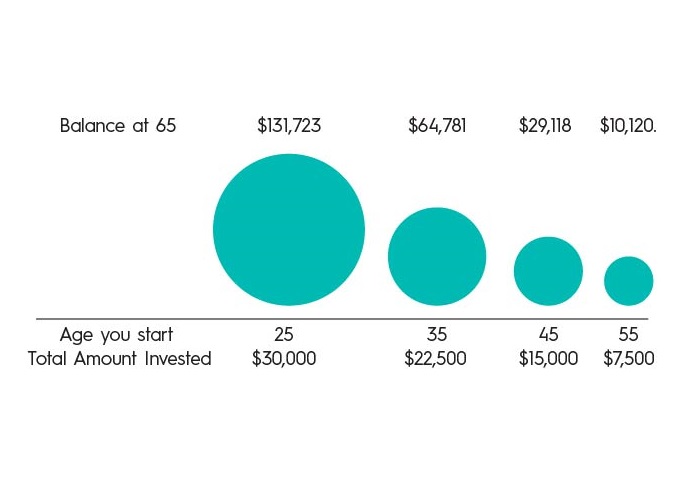

Compound Interest Calculator Daily Monthly Quarterly Annual

403 B Vs 457 B What S The Difference Smartasset

Future Value Calculator

457 Deferred Compensation Plan

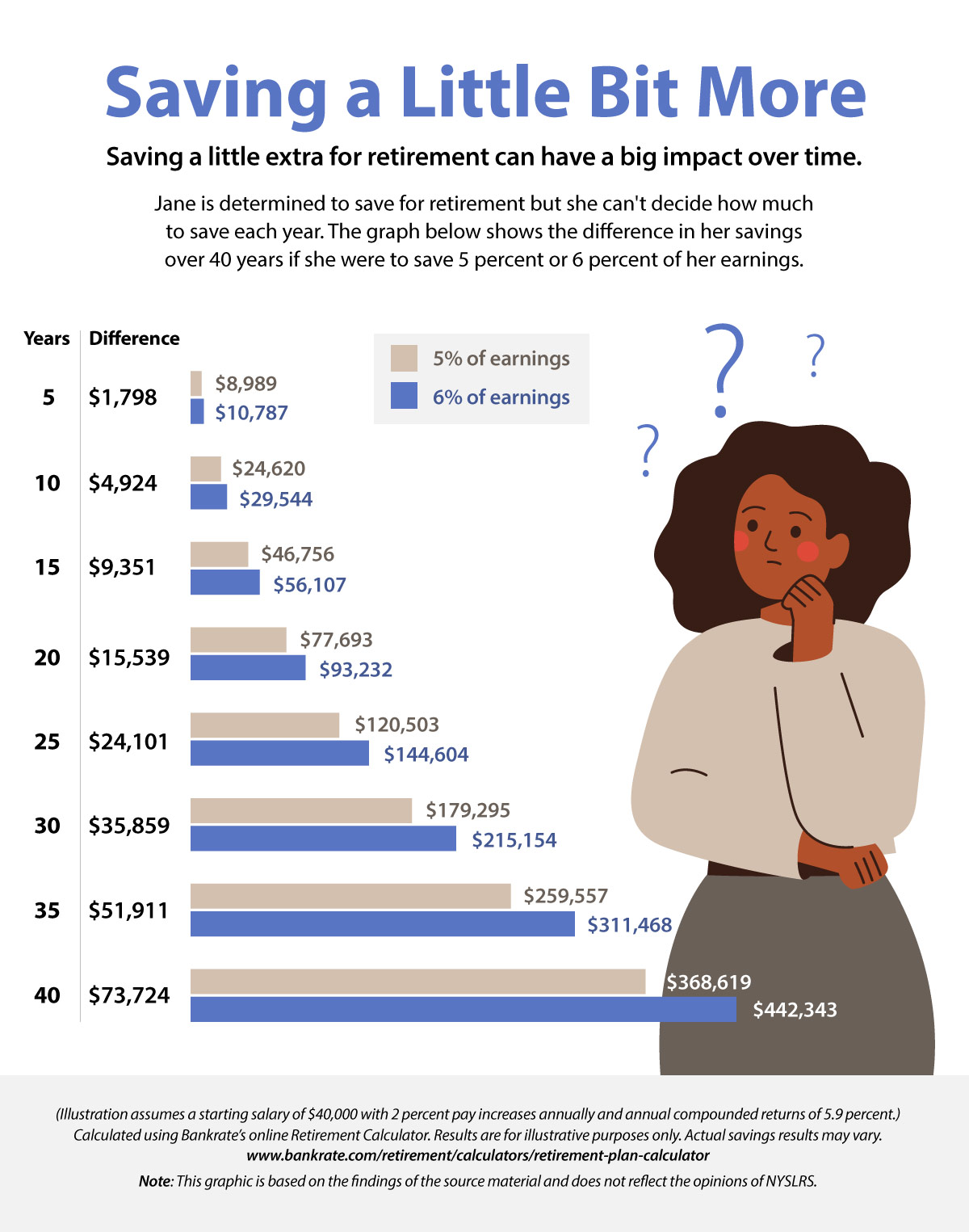

Give Your Retirement Savings A Boost New York Retirement News

Retirement Income Calculator Faq

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Retirement Calculator Sams Investment Strategies

Financial Calculators Lally Co